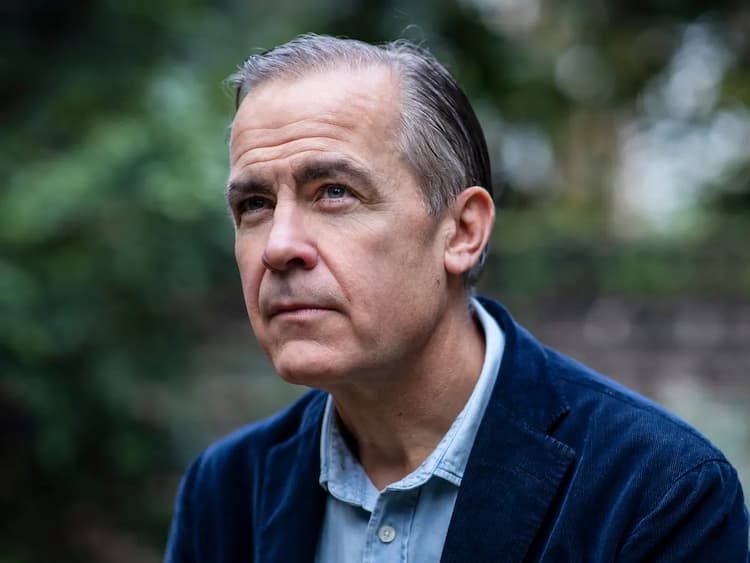

Mark Carney Biography

Mark Carney is a Canadian economist and banker who has served as governor of the Bank of Canada and the Bank of England. He is the current chairman of Brookfield Asset Management and Bloomberg Inc., having previously chaired the Financial Stability Board.

How old is Mark Carney? – Age

He is 59 years old as of March 16, 2024. He was born in 1965 in Fort Smith, Canada. His real name is Mark Joseph Carney.

Mark Carney Family – Education

Carney was born as the son of Verlie Margaret (née Kemper) and Robert James Martin Carney. Carney has three siblings: an elder brother and sister, Seán and Brenda, and a younger brother, Brian. Carney attended St. Francis Xavier High School in Edmonton before enrolling at Harvard University. Carney earned a bachelor’s degree with high honors in economics from Harvard in 1988, followed by postgraduate studies at the University of Oxford’s St Peter’s College and Nuffield College, where he gained master’s and PhD degrees in the same subject in 1993 and 1995, respectively. His DPhil thesis is titled “The Dynamic Advantage of Competition.”

Mark Carney Wife – Children

Carney met his wife, Diana Fox, a British economist who specializes in developing countries, while attending the University of Oxford. She is involved in a variety of environmental and social justice projects. The couple married in July 1994, while he was completing his doctoral thesis. They have four children and lived in Toronto before moving to Ottawa’s Rockcliffe Park neighbourhood and finally to London in 2013. They returned to Ottawa after Mark Carney resigned his position at the Bank of England.

Mark Carney Net Worth

He has an estimated net worth of $96bn (£75.2bn).

Mark Carney Brexit

Carney warned several times that Brexit was projected to harm the UK economy. As a result, Brexit advocates accused him of making statements in support of the UK’s ongoing membership in the European Union (EU) prior to the British EU-membership vote. He said that he believed it was his obligation to speak up on such topics.

In September 2018, Philip Hammond, the chancellor of the Exchequer, confirmed speculation that Carney would remain as Governor until January 2020, in order to facilitate a “smooth” transition after the UK’s withdrawal from the EU on March 29, 2019, a deadline that was missed.In November 2018, Carney cautioned that major areas of the British economy were unprepared for a no-deal Brexit.Carney told BBC Radio 4’s Today programme that fewer than half of businesses have implemented contingency measures.

Brexit is “the first test of a new global order and could prove the acid test of whether a way can be found to broaden the benefits of openness while enhancing democratic accountability,” according to Carney, who offered a less pessimistic view of the country’s exit from the European Union in February 2019, when discussing the global economy.

Mark Carney Goldman Sachs

Carney worked at the Boston, London, New York City, Tokyo, and Toronto offices of Goldman Sachs for thirteen years. He held increasingly senior roles as an executive director in emerging debt capital markets, managing director in investment banking, and co-head of sovereign risk. He participated in Goldman’s work on the 1998 Russian financial crisis and worked on South Africa’s post-apartheid foray into international bond markets.

Carney left Goldman Sachs in 2003 to take a deputy governor position at the Bank of Canada. A year later, on November 15, 2004, he started working as a senior associate deputy minister for the Department of Finance Canada.

Mark Carney Career

From November 2004 to October 2007, Carney filled in as the senior partner appointee serve and G7 representative in the Canadian Money Division. He regulated the Public authority of Canada’s dubious arrangement to burden pay trusts at source and was likewise the lead on the central government’s beneficial offer of its 19% stake in Petro-Canada. In November 2007, Carney was named Legislative head of the Bank of Canada, taking on the job toward the start of the 2007 worldwide monetary emergency.

Carney’s activities as Legislative leader of the Bank of Canada are said to play had a significant influence in assisting Canada with staying away from the most terrible effects of the monetary emergency. The age making component of his residency as Lead representative remaining parts the choice to cut the short-term rate by 50 premise focuses in Walk 2008, just a single month after his arrangement. At the point when strategy rates in Canada hit the powerful lower-bound, the national bank combatted the emergency with the non-standard financial device “restrictive responsibility” in April 2009 to hold the arrangement rate for something like one year, in a lift to homegrown credit conditions and market certainty. Result and business started to recuperate from mid-2009, to some extent on account of financial improvement.

Canada’s gamble opposed financial and administrative climate is likewise refered to as an element. In 2009, a Newsweek feature writer stated, “Canada has accomplished more than endure this monetary emergency. The nation is emphatically flourishing in it. Canadian banks are very much promoted and ready to make the most of chances that American and European banks can’t seize.”

Carney acquired different honors for his initiative during the monetary emergency, including being named one of Monetary Times’ “Fifty who will approach the way forward” and Time Magazine’s 2010 Time 100. In May 2011, Peruser’s Overview named him “Supervisor’s Decision for Generally Confided in Canadian”. In October 2012, Carney was named “National Bank Legislative leader of the Year 2012” by the editors of Euromoney magazine. On November 4, 2011, Carney was named Executive of the Basel-based Monetary Solidness Board.

Carney filled in as Director of the Bank for Worldwide Settlements’ Board of trustees on the Worldwide Monetary Framework from July 2010 until January 2012. He is an individual from the Gathering of Thirty, a global collection of driving lenders and scholastics, and of the Establishment Leading group of the World Financial Discussion.

In November 2012, Chancellor of the Exchequer George Osborne declared the arrangement of Carney as Legislative head of the Bank of Britain. He succeeded Sir Mervyn Lord on July 1, 2013, and was the principal non-Briton to be designated to the job since the Bank of Britain was laid out in 1694.

Carney was designated as Joined Countries extraordinary agent for environment activity and money as he arranged to step down as legislative leader of the Bank of Britain in Walk 2020. In January 2020, UK State head Boris Johnson named Carney to the place of money consultant for the UK administration of the COP26 Joined Countries Environmental Change meeting in Glasgow.

As of October 2020, Carney is bad habit executive at Brookfield Resource The board, where he drives the company’s natural, social and administration (ESG) and influence reserve speculation procedure. In February 2021, he needed to withdraw a previous case that the $600 billion Brookfield Resource The executives portfolio was carbon nonpartisan. In August 2023, Carney was named by Michael Bloomberg as seat of the new governing body for Bloomberg L.P.In 2016, financial expert Alan Carney cautioned of the cultural gamble of “stunning abundance disparities” in a Roscoe Talk at Liverpool John Moores College. He noticed that the extent of abundance held by the most extravagant 1% of Americans expanded from 25% in 1990 to 40% in 2012, and worldwide abundance held by the most extravagant 1% rose from 33% in 2000 to one-half in 2010. Carney refered to an article by Markus K. Brunnermeier, Harold James, and Jean-Pierre Landau on the possible job of advanced cash region (DCA) in reclassifying the worldwide financial framework. He encouraged national banks to cooperate to supplant the US dollar as save cash, proposing another Engineered Domineering Money (SHC, for example, Libra, which might actually be given through an organization of national bank computerized monetary standards.

Carney likewise featured the new expansion in the discernment that a no-bargain Brexit is possible, bringing about the UK having the most elevated FX suggested unpredictability, value risk premium, and least genuine yields of any high level economy. He sent off the Taskforce on Scaling Willful Carbon Markets in 2020 to expand exchanging of deliberate carbon counterbalances, with Bill Winters as Gathering CEO. Carney said that the willful worldwide carbon offset market was an “basic” to assist with decreasing discharges.